Assessing the Balance of Power in a Business Situation

The Porter's Five Forces tool is a simple but powerful tool for understanding where power lies in a business situation. This is useful, because it helps you understand both the strength of your current competitive position, and the strength of a position you're considering moving into.

With a clear understanding of where power lies, you can take fair advantage of a situation of strength, improve a situation of weakness, and avoid taking wrong steps. This makes it an important part of your planning toolkit.

Conventionally, the tool is used to identify whether new products, services or businesses have the potential to be profitable. However it can be very illuminating when used to understand the balance of power in other situations.

Understanding the Tool:

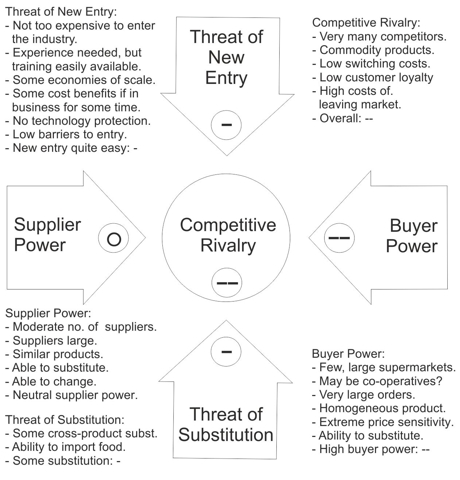

Five Forces Analysis assumes that there are five important forces that determine competitive power in a business situation. These are:

Supplier Power: Here you assess how easy it is for suppliers to drive up prices. This is driven by the number of suppliers of each key input, the uniqueness of their product or service, their strength and control over you, the cost of switching from one to another, and so on. The fewer the supplier choices you have, and the more you need suppliers' help, the more powerful your suppliers are.

Buyer Power: Here you ask yourself how easy it is for buyers to drive prices down. Again, this is driven by the number of buyers, the importance of each individual buyer to your business, the cost to them of switching from your products and services to those of someone else, and so on. If you deal with few, powerful buyers, then they are often able to dictate terms to you.

Competitive Rivalry: What is important here is the number and capability of your competitors. If you have many competitors, and they offer equally attractive products and services, then you'll most likely have little power in the situation, because suppliers and buyers will go elsewhere if they don't get a good deal from you. On the other hand, if no-one else can do what you do, then you can often have tremendous strength.

Threat of Substitution: This is affected by the ability of your customers to find a different way of doing what you do – for example, if you supply a unique software product that automates an important process, people may substitute by doing the process manually or by outsourcing it. If substitution is easy and substitution is viable, then this weakens your power.

Threat of New Entry: Power is also affected by the ability of people to enter your market. If it costs little in time or money to enter your market and compete effectively, if there are few economies of scale in place, or if you have little protection for your key technologies, then new competitors can quickly enter your market and weaken your position. If you have strong and durable barriers to entry, then you can preserve a favorable position and take fair advantage of it.

These forces can be neatly brought together in a diagram like the one in figure 1 below:

Figure 1 - Porter's Five Forces

Use the Tool

Brainstorm the relevant factors for your market or situation, and then check against the factors listed for the force in the diagram above.

Then, mark the key factors on the diagram, and summarize the size and scale of the force on the diagram. An easy way of doing this is to use, for example, a single "+" sign for a force moderately in your favor, or "--" for a force strongly against you (you can see this in the example below).

Then look at the situation you find using this analysis and think through how it affects you. Bear in mind that few situations are perfect; however looking at things in this way helps you think through what you could change to increase your power with respect to each force. What’s more, if you find yourself in a structurally weak position, this tool helps you think about what you can do to move into a stronger one.

This tool was created by Harvard Business School professor, Michael Porter, to analyze the attractiveness and likely-profitability of an industry. Since publication, it has become one of the most important business strategy tools. The classic article which introduces it is "How Competitive Forces Shape Strategy" in Harvard Business Review 57, March – April 1979, pages 86-93.

Example:

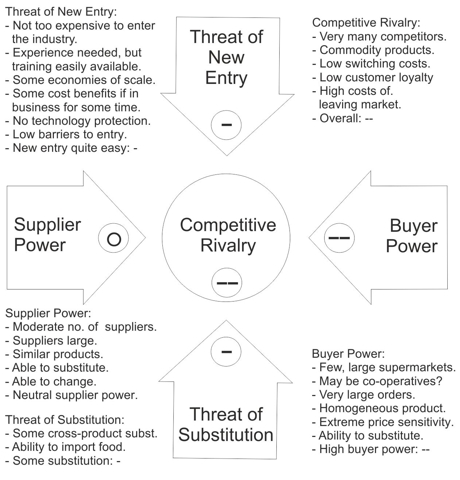

Martin Johnson is deciding whether to switch career and become a farmer – he's always loved the countryside, and wants to switch to a career where he's his own boss. He creates the following Five Forces Analysis as he thinks the situation through:

Figure 2 - Porter's Five Forces Example - Buying a Farm

This worries him:

The threat of new entry is quite high: if anyone looks as if they're making a sustained profit, new competitors can come into the industry easily, reducing profits.

Competitive rivalry is extremely high: if someone raises prices, they'll be quickly undercut. Intense competition puts strong downward pressure on prices.

Buyer Power is strong, again implying strong downward pressure on prices.

There is some threat of substitution.

Unless he is able to find some way of changing this situation, this looks like a very tough industry to survive in. Maybe he'll need to specialize in a sector of the market that's protected from some of these forces, or find a related business that's in a stronger position.

Key Points:

Porter's Five Forces Analysis is an important tool for assessing the potential for profitability in an industry. With a little adaptation, it is also useful as a way of assessing the balance of power in more general situations.

It works by looking at the strength of five important forces that affect competition:

Supplier Power: The power of suppliers to drive up the prices of your inputs.

Buyer Power: The power of your customers to drive down your prices.

Competitive Rivalry: The strength of competition in the industry.

The Threat of Substitution: The extent to which different products and services can be used in place of your own.

The Threat of New Entry: The ease with which new competitors can enter the market if they see that you are making good profits (and then drive your prices down).

By thinking about how each force affects you, and by identifying the strength and direction of each force, you can quickly assess the strength of your position and your ability to make a sustained profit in the industry.

You can then look at how you can affect each of the forces to move the balance of power more in your favor.