| Top 10 Banks | ($m) | vs. Prev Period* | M&A | Equity | Bonds | Loans | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| JP Morgan | 5,931.29 |

+10%

|

| |||||||

| Bank of America Merrill Lynch | 5,455.47 |

+22%

|

| |||||||

| Goldman Sachs | 4,791.85 |

+20%

|

| |||||||

| Morgan Stanley | 4,174.06 |

+13%

|

| |||||||

| Citi | 3,809.59 |

+7%

|

| |||||||

| Deutsche Bank | 3,421.03 |

+6%

|

| |||||||

| Credit Suisse | 3,327.84 |

0%

|

| |||||||

| Barclays | 3,294.17 |

+5%

|

| |||||||

| Wells Fargo | 2,136.43 |

+15%

|

| |||||||

| RBC Capital Markets | 1,901.07 |

+7%

|

| |||||||

| Total | 78,678.70 |

+6%

|

| |||||||

Friday, January 31, 2014

Top Investment Banks - FT List

10 ways telecom can make money in the future a.k.a. telecom revenue 2.0

LTE roll-outs

are taking place in America and Europe. Over-the-top-players are likely

to start offering large-scale and free HD mobile VoIP over the next

6-18 months. Steeply declining ARPU will be the result. The telecom

industry needs new revenue: telecom revenue 2.0. How can they do it?

1. Become a Telecom Venture Capitalist

Buying the number 2 o 3 player in a new market or creating a copy-cat

solution has not worked. Think about Terra/Lycos/Vivendi portals,

Keteque, etc. So the better option is to make sure innovative startups

get partly funded by telecom operators. This assures that operators will

be able to launch innovative solutions in the future. Just being a VC

will not be enough. Also investment in quickly launching the new startup

services and incorporating them into the existing product catalog are

necessary.

2. SaaSification & Monetization

SaaS monetization is not reselling SaaS and keeping a

30-50% revenue share. SaaS monetization means offering others the

development/hosting tools, sales channels, support facilities, etc. to

quickly launch new SaaS solutions that are targeted at new niche or long

tail segments. SaaSification means that existing license-based on-site

applications can be quickly converted into subscription-based SaaS

offerings. The operator is a SaaS enabler and brings together SaaS

creators with SaaS customers.

3. Enterprise Mobilization, BPaaS and BYOD

There are millions of small, medium and large enterprises that have

employees which bring smartphones and tablets to work [a.k.a. BYOD -

bring-your-own-device]. Managing these solutions (security,

provisioning, etc.) as well as mobilizing applications and internal

processes [a.k.a. BPaaS - business processes as a service] will be a big

opportunity. Corporate mobile app and mobile SaaS stores will be an

important starting point. Solutions to quickly mobilize existing

solutions, ideally without programming should come next.

4. M2M Monetization Solutions

At the moment M2M is not having big industry standards yet. Operators

are ideally positioned to bring standards to quickly connect millions

of devices and sensors to value added services. Most of these solutions

will not be SIM-based so a pure-SIM strategy is likely to fail.

Operators should think about enabling others to take advantage of the

M2M revolution instead of building services themselves. Be the

restaurant, tool shop and clothing store and not the gold digger during a

gold rush.

5. Big Data and Data Intelligence as a Service

Operators are used to manage peta-bytes of data. However converting

this data into information and knowledge is the next step towards

monetizing data. At the moment big data solutions focus on storing,

manipulating and reporting large volume of data. However the Big Data

revolution is only just starting. We need big data apps, big data app

stores, “big datafication” tools, etc.

6. All-you-can-eat HD Video-on-Demand

Global content distribution can be better done with the help of

operators then without. Exporting Netflix-like business models to

Europe, Asia, Africa, Latin-America, etc. is urgently necessary if

Hollywood wants to avoid the next generation believing “content = free”.

All-you-can-eat movies, series and music for €15/month is what should

be aimed for.

7. NFC, micro-subscriptions, nano-payments, anonymous digital cash, etc.

Payment solutions are hot. Look at Paypal, Square,

Dwolla, etc. Operators could play it nice and ask Visa, Mastercard, etc.

how they can assist. However going a more disruptive route and helping

Square and Dwolla serve a global marketplace are probably more

lucrative. Except for NFC solutions also micro-subscriptions (e.g.

€0.05/month) or nano-payments (e.g. €0.001/transaction) should be looked

at.

Don’t forget that people will still want to buy things in a digital

world which they do not want others to know about or from people or

companies they do not trust. Anonymous digital cash solutions are needed

when physical cash is no longer available. Unless of course you expect

people to buy books about getting a divorce with the family’s credit

card…

8. Build your own VAS for consumers and enterprises – iVAS.

Conference calls, PBX, etc. were the most advanced

communication solutions offered by operators until recently. However

creating visual drag-and-drop environments in which non-technical users

can combine telecom and web assets to create new value-added-services

can result in a new generation of VAS: iVAS. The VAS in which personal

solutions are resolved by the people who suffer them. Especially in

emerging countries where wide-spread smartphones and LTE are still some

years off, iVAS can still have some good 3-5 years ahead. Examples would

be personalized numbering schemas for my family & friends,

distorting voices when I call somebody, etc. Let consumers and small

enterprises be the creators by offering them visual do-it-yourself

tools. Combine solutions like Invox, OpenVBX, Google’s App Inventor,

etc.

9. Software-defined networking solutions & Network as a Service

Networks are changing from hardware to software. This means network

virtualization, outsourcing of network solutions (e.g. virtualized

firewalls), etc. Operators are in a good position to offer a new

generation of complex network solutions that can be very easily managed

via a browser. Enterprises could substitute expensive on-site hardware

for cheap monthly subscriptions of virtualized network solutions.

10. Long-Tail Solutions

Operators could be offering a large catalog of long-tail solutions

that are targeted at specific industries or problem domains. Thousands

of companies are building multi-device solutions. Mobile & SmartTV

virtualization and automated testing solutions would be of interest to

them. Low-latency solutions could be of interest to the financial

sector, e.g. automated trading. Call center and customer support

services on-demand and via a subscription model. Many possible services

in the collective intelligence, crowd-sourcing, gamification, computer

vision, natural language processing, etc. domains.

Basically operators should create new departments that are

financially and structurally independent from the main business and that

look at new disruptive technologies/business ideas and how either

directly or via partners new revenue can be generated with them.

What not to do?

Waste any more time. Do not focus on small or

late-to-market solutions, e.g. reselling Microsoft 365, RCS like Joyn,

etc. Focus on industry-changers, disruptive innovations, etc.

Yes LTE roll-out is important but without any solutions for telecom

revenue 2.0, LTE will just kill ARPU. So action is required now. Action

needs to be quick [forget about RFQs], agile [forget about standards -

the iPhone / AppStore is a proprietary solution], well subsidized [no

supplier will invest big R&D budgets to get a 15% revenue share]

and independent [of red tape and corporate control so risk taking is

rewarded, unless of course you predicted 5 years ago that Facebook and

Angry Bird would be changing industries]…

Refer: http://telruptive.com/2012/03/26/10-ways-telecom-can-make-money-in-the-future-a-k-a-telecom-revenue-2-0/

Refer: http://telruptive.com/2012/03/26/10-ways-telecom-can-make-money-in-the-future-a-k-a-telecom-revenue-2-0/

Thursday, January 30, 2014

Priciing Strategies

Marketing - Pricing approaches and strategies

There are three main approaches a business takes to setting price:

Cost-based pricing: price is determined by adding a profit element on top of the cost of making the product.

Customer-based pricing: where prices are determined by what a firm believes customers will be prepared to pay

Competitor-based pricing: where competitor prices are the main influence on the price set

Let’s take a brief look at each of these approaches;

Cost based pricing

This involves setting a price by adding a fixed amount or percentage to the cost

of making or buying the product. In some ways this is quite an

old-fashioned and somewhat discredited pricing strategy, although it is

still widely used.

After all, customers are not too bothered what it cost to make the product – they are interested in what value the product provides them.

Cost-plus (or “mark-up”) pricing is widely

used in retailing, where the retailer wants to know with some certainty

what the gross profit margin of each sale will be. An advantage of

this approach is that the business will know that its costs are being

covered. The main disadvantage is that cost-plus pricing may lead to

products that are priced un-competitively.

Here is an example of cost-plus pricing, where a business

wishes to ensure that it makes an additional £50 of profit on top of the

unit cost of production.

| Unit cost |

£100

|

| Mark-up |

50%

|

| Selling price |

£150

|

How high should the mark-up percentage be? That largely

depends on the normal competitive practice in a market and also whether

the resulting price is acceptable to customers.

In the UK a standard retail mark-up is 2.4 times the cost

the retailer pays to its supplier (normally a wholesaler). So, if the

wholesale cost of a product is £10 per unit, the retailer will look to

sell it for 2.4x £10 = £24. This is equal to a total mark-up of £14

(i.e. the selling price of £24 less the bought cost of £10).

The main advantage of cost-based pricing is that selling

prices are relatively easy to calculate. If the mark-up percentage is

applied consistently across product ranges, then the business can also

predict more reliably what the overall profit margin will be.

Customer-based pricing

Penetration pricing

You often see the tagline “special introductory offer” – the classic sign of penetration pricing. The aim of penetration pricing is usually to increase market share of a product, providing the opportunity to increase price once this objective has been achieved.

Penetration pricing is the pricing technique of setting a relatively low initial entry price, usually lower than the intended established price, to attract new customers. The strategy aims to encourage customers to switch to the new product because of the lower price.

Penetration pricing is most commonly associated with a marketing objective

of increasing market share or sales volume. In the short term,

penetration pricing is likely to result in lower profits than would be

the case if price were set higher. However, there are some significant

benefits to long-term profitability of having a higher market share,

so the pricing strategy can often be justified.

Penetration pricing is often used to support the launch of a

new product, and works best when a product enters a market with

relatively little product differentiation and where demand is price

elastic – so a lower price than rival products is a competitive

weapon.

Price skimming

Skimming involves setting a high price before other competitors come into the market.

This is often used for the launch of a new product which faces little

or no competition – usually due to some technological features. Such

products are often bought by “early adopters” who are prepared to pay a higher price to have the latest or best product in the market.

Good examples of price skimming include innovative electronic products, such as the Apple iPad and Sony PlayStation 3.

There are some other problems and challenges with this approach:

Price skimming as a strategy cannot last for long, as

competitors soon launch rival products which put pressure on the price

(e.g. the launch of rival products to the iPhone or iPod).

Distribution (place) can also be a challenge for an

innovative new product. It may be necessary to give retailers higher

margins to convince them to stock the product, reducing the improved

margins that can be delivered by price skimming.

A final problem is that by price skimming, a firm may slow

down the volume growth of demand for the product. This can give

competitors more time to develop alternative products ready for the

time when market demand (measured in volume) is strongest.

Loss leaders

The use of loss leaders is a method of sales promotion. A

loss leader is a product priced below cost-price in order to attract

consumers into a shop or online store. The purpose of making a product a

loss leader is to encourage customers to make further purchases of

profitable goods while they are in the shop. But does this strategy

work?

Pricing is a key competitive weapon and a very flexible part of the marketing mix.

If a business undercuts its competitors on price, new

customers may be attracted and existing customers may become more loyal.

So, using a loss leader can help drive customer loyalty.

One risk of using a loss leader is that customers may take

the opportunity to “bulk-buy”. If the price discount is sufficiently

deep, then it makes sense for customers to buy as much as they can

(assuming the product is not perishable).

Using a loss leader is essentially a short-term pricing

tactic for any one product. Customers will soon get used to the

tactic, so it makes sense to change the loss leader or its

merchandising every so often.

Predatory pricing (note: this is illegal)

With predatory pricing, prices are deliberately set very low by a dominant competitor in the market in order to restrict or prevent competition.

The price set might even be free, or lead to losses by the predator.

Whatever the approach, predatory pricing is illegal under competition

law.

Psychological pricing

Sometimes prices are set at what seem to be unusual price

points. For example, why are DVD’s priced at £12.99 or £14.99? The

answer is the perceived price barriers that customers

may have. They will buy something for £9.99, but think that £10 is a

little too much. So a price that is one pence lower can make the

difference between closing the sale, or not!

The aim of psychological pricing is to make

the customer believe the product is cheaper than it really is.

Pricing in this way is intended to attract customers who are looking

for “value”.

Competitor-based pricing

If there is strong competition in a market, customers are

faced with a wide choice of who to buy from. They may buy from the

cheapest provider or perhaps from the one which offers the best

customer service. But customers will certainly be mindful of what is a

reasonable or normal price in the market.

Most firms in a competitive market do not have sufficient

power to be able to set prices above their competitors. They tend to use

“going-rate” pricing – i.e. setting a price that is in line with the prices charged by direct competitors. In effect such businesses are “price-takers” – they must accept the going market price as determined by the forces of demand and supply.

An advantage of using competitive pricing is that selling

prices should be line with rivals, so price should not be a competitive

disadvantage.

The main problem is that the business needs some other way to attract

customers. It has to use non-price methods to compete – e.g. providing

distinct customer service or better availability.

Refer: http://www.tutor2u.net/business/gcse/marketing_pricing_strategies.htm

Saturday, January 25, 2014

Ten ways to become resilient

1. Understand that Setbacks are Part of Life

Life is not always cozy and fun. It is also characterized by complexity and challenges. They belong to life like the night is part of the day. Without night there would be no day. Without pain there would be no joy. While we often cannot avoid all the problems, we can choose to stay flexible, open-minded, and determined to succeed.

2. Be aware of Yourself and the Environment

Resilient people are aware of themselves, the environment, and their own emotional reactions to those around them. They have understood the importance of evaluating the reasons of their feelings by constantly observing themselves. This enables them to take control of the situation and to develop various options of behaving and acting.

3. Believe and know that You are in Control

If you are a resilient person, then you have a so-called Internal Locus of Control. You believe that you can control your life, you do not believe that you are defined by external factors which you can´t control. Instead, you feel that you have the power to make choices and take actions that will affect your success rate.

4. Become a Solution Thinker

When a difficult situation arises, resilient people would always think of solutions. They would act calmly, would review holistically the task at hand, and would be able to spot possible solutions. If not, they would envision them. Next time you encounter a new challenge, make a quick list of some of the potential ways you could solve it. Experiment with different strategies and focus on developing a logical way to work through it.

5. Believe in Yourself

You are unique. You are beautiful. You have proven already so often in life that you are an achiever. Remind yourself of your strengths and accomplishments. Believe in yourself and become more confident about your own abilities and strengths.

6. Set Goals and define manageable Milestones

Difficult situations can be extremely daunting. Resilient people are able to view these situations in a realistic way, and then set reasonable goals to deal with the problem. When you find yourself becoming overwhelmed by a situation, take a step back to simply assess what is before you. Brainstorm possible solutions, and then break them down into manageable steps. Be willing to adapt, if necessary. Remain flexible and embrace change.

7. Stay optimistic

Keeping a hopeful attitude during turbulent times is another key part of resilience. This does not mean ignoring problems at hand in order to focus on positive outcomes. It means understanding that setbacks are transient and that you have the skills and abilities to combat the challenges you face. What you are dealing with may be difficult, but it is important to remain hopeful and positive about a brighter future. View yourself as winner, not as a loser.

8. Be brave and ask for Help

Resilient people are mature enough to admit that they can´t know everything. They are also strong enough to admit, if they feel that their energy level is going down and that they need to re-charge their batteries by receiving outside know-how, advice, support, etc. from any potential source of assistance. In this respect it helps if you have a good social network. If you can exchange with family, friends, or colleagues in order to gain new perspectives and/ or motivation.

9. Take it easy

Even the best among us will not be able to achieve everything. Even if they are properly prepared, have done their homework, can rely on an excellent support network, are super optimistic, and absolutely committed. There are still factors outside of our control. And, most importantly, often things just need time to evolve and to develop. Resilient people understand that sometimes the best recipe of success is to step back and to wait. They know that patience often pays off. They do not get stressed out in such situations. Rather they relax, re-focus on themselves and getting ready for possible next steps.

10. Nurture Yourself

When you're stressed, it can be all too easy to neglect your own needs. Losing your appetite, ignoring exercise, and not getting enough sleep are all common reactions to a crisis situation. Focus on building your self-nurture skills, even when you are troubled. Make time for activities that you enjoy. By taking care of your own needs, you can boost your overall health and resilience and be fully ready to face life's challenges.

Life is not always cozy and fun. It is also characterized by complexity and challenges. They belong to life like the night is part of the day. Without night there would be no day. Without pain there would be no joy. While we often cannot avoid all the problems, we can choose to stay flexible, open-minded, and determined to succeed.

2. Be aware of Yourself and the Environment

Resilient people are aware of themselves, the environment, and their own emotional reactions to those around them. They have understood the importance of evaluating the reasons of their feelings by constantly observing themselves. This enables them to take control of the situation and to develop various options of behaving and acting.

3. Believe and know that You are in Control

If you are a resilient person, then you have a so-called Internal Locus of Control. You believe that you can control your life, you do not believe that you are defined by external factors which you can´t control. Instead, you feel that you have the power to make choices and take actions that will affect your success rate.

4. Become a Solution Thinker

When a difficult situation arises, resilient people would always think of solutions. They would act calmly, would review holistically the task at hand, and would be able to spot possible solutions. If not, they would envision them. Next time you encounter a new challenge, make a quick list of some of the potential ways you could solve it. Experiment with different strategies and focus on developing a logical way to work through it.

5. Believe in Yourself

You are unique. You are beautiful. You have proven already so often in life that you are an achiever. Remind yourself of your strengths and accomplishments. Believe in yourself and become more confident about your own abilities and strengths.

6. Set Goals and define manageable Milestones

Difficult situations can be extremely daunting. Resilient people are able to view these situations in a realistic way, and then set reasonable goals to deal with the problem. When you find yourself becoming overwhelmed by a situation, take a step back to simply assess what is before you. Brainstorm possible solutions, and then break them down into manageable steps. Be willing to adapt, if necessary. Remain flexible and embrace change.

7. Stay optimistic

Keeping a hopeful attitude during turbulent times is another key part of resilience. This does not mean ignoring problems at hand in order to focus on positive outcomes. It means understanding that setbacks are transient and that you have the skills and abilities to combat the challenges you face. What you are dealing with may be difficult, but it is important to remain hopeful and positive about a brighter future. View yourself as winner, not as a loser.

8. Be brave and ask for Help

Resilient people are mature enough to admit that they can´t know everything. They are also strong enough to admit, if they feel that their energy level is going down and that they need to re-charge their batteries by receiving outside know-how, advice, support, etc. from any potential source of assistance. In this respect it helps if you have a good social network. If you can exchange with family, friends, or colleagues in order to gain new perspectives and/ or motivation.

9. Take it easy

Even the best among us will not be able to achieve everything. Even if they are properly prepared, have done their homework, can rely on an excellent support network, are super optimistic, and absolutely committed. There are still factors outside of our control. And, most importantly, often things just need time to evolve and to develop. Resilient people understand that sometimes the best recipe of success is to step back and to wait. They know that patience often pays off. They do not get stressed out in such situations. Rather they relax, re-focus on themselves and getting ready for possible next steps.

10. Nurture Yourself

When you're stressed, it can be all too easy to neglect your own needs. Losing your appetite, ignoring exercise, and not getting enough sleep are all common reactions to a crisis situation. Focus on building your self-nurture skills, even when you are troubled. Make time for activities that you enjoy. By taking care of your own needs, you can boost your overall health and resilience and be fully ready to face life's challenges.

Thursday, January 23, 2014

SPSS tutorial: Questionnaire data entry - your questions answered

SPSS for newbies: questionnaire data entry

Using SPSS Modeler to segment customers in a Telco scenario

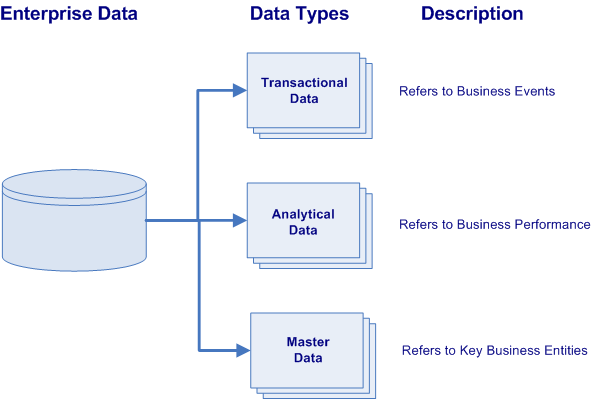

Enterprise Data Types

- All business enterprises have three varieties of physical data located within their numerous information systems. These varieties of data are characterized by their data types and their purpose within the organization.

- • Transactional Data

- • Analytical Data

- • Master Data

Transactional data supports the daily operations of an organization (i.e. describes business events). Analytical data supports decision-making, reporting, query, and analysis (i.e. describes business performance). While master data represents the key business entities upon which transactions are executed and the dimensions around which analysis is conducted (i.e. describes key business entities).

Transactional data supports the daily operations of an organization (i.e. describes business events). Analytical data supports decision-making, reporting, query, and analysis (i.e. describes business performance). While master data represents the key business entities upon which transactions are executed and the dimensions around which analysis is conducted (i.e. describes key business entities).

Transactional Data

Transactional data are the elements that support the on-going operations of an organization and are included in the application systems that automate key business processes. This can include areas such as sales, service, order management, manufacturing, purchasing, billing, accounts receivable and accounts payable. Commonly, transactional data refers to the data that is created and updated within the operational systems. Examples of transactional data included the time, place, price,discount, payment methods, etc. used at the point of sale. Transactional data is normally stored within normalized tables within Online Transaction Processing (OLTP) systems and are designed for integrity. Rather than being the objects of a transaction such as customer or product, transactional data is the describing data including time and numeric values.

Analytical Data

Analytical data are the numerical values, metrics, and measurements that provide business intelligence and support organizational decision making. Typically analytical data is stored in Online Analytical Processing (OLAP) repositories optimized for decision support, such as enterprise data warehouses and department data marts. Analytical data is characterized as being the facts and numerical values in a dimensional model. Normally, the data resides in fact tables surrounded by key dimensions such as customer, product, account, location, and date/time. However, analytical data are defined as the numerical measurements rather than being the describing data.

Master Data

Master data is usually considered to play a key role in the core operation of a business. Moreover, master data refers to the key organizational entities that are used by several functional groups and are typically stored in different data systems across an organization. Additionally, master data represents the business entities around which the organization’s business transactions are executed and the primary elements around which analytics are conducted. Master data is typically persistent, non-transactional data utilized by multiple systems that defines the primary business entities. Master data may include data about customers, products, employees, inventory, suppliers, and sites.

Refer: http://bi-insider.com/posts/types-of-enterprise-data-transactional-analytical-master/

Thursday, January 16, 2014

Value Stream Mapping

Value stream mapping is a lean manufacturing or lean enterprise

technique used to document, analyze and improve the flow of information

or materials required to produce a product or service for a customer.

Full definition.

———-

Value stream mapping is a paper and pencil tool that helps you to see and understand the flow of material and information as a product or service makes its way through the value stream. Value stream mapping is typically used in Lean, it differs from the process mapping of Six Sigma in four ways:

1) It gathers and displays a far broader range of information than a typical process map.

2) It tends to be at a higher level (5-10 boxes) than many process maps.

3) It tends to be used at a broader level, i.e. from receiving of raw material to delivery of finished goods.

4) It tends to be used to identify where to focus future projects, subprojects, and/or kaizen events.

———-

A value stream map (AKA end-to-end system map) takes into account not only the activity of the product, but the management and information systems that support the basic process. This is especially helpful when working to reduce cycle time, because you gain insight into the decision making flow in addition to the process flow. It is actually a Lean tool.

The basic idea is to first map your process, then above it map the information flow that enables the process to occur.

———-

Value stream mapping is a paper and pencil tool that helps you to see and understand the flow of material and information as a product or service makes its way through the value stream. Value stream mapping is typically used in Lean, it differs from the process mapping of Six Sigma in four ways:

1) It gathers and displays a far broader range of information than a typical process map.

2) It tends to be at a higher level (5-10 boxes) than many process maps.

3) It tends to be used at a broader level, i.e. from receiving of raw material to delivery of finished goods.

4) It tends to be used to identify where to focus future projects, subprojects, and/or kaizen events.

———-

A value stream map (AKA end-to-end system map) takes into account not only the activity of the product, but the management and information systems that support the basic process. This is especially helpful when working to reduce cycle time, because you gain insight into the decision making flow in addition to the process flow. It is actually a Lean tool.

The basic idea is to first map your process, then above it map the information flow that enables the process to occur.

Wednesday, January 15, 2014

Saturday, January 11, 2014

What is the difference between accounting and finance (and economics)?

Accounting:

Refer:http://thefinancepig.com/2008/03/21/what-is-the-difference-between-accounting-and-finance-and-economics/

Accounting is the preparation of accounting records. This includes measuring, preparation, analyzing, and the interpretation of financial statements. Accounting is also often referred to as the voice of business, the language of business, and the heart of business. Mostly

because the financial documents derived from the accounting preparation

are widely used among managers, investors, tax authorities, executives,

and many others to see how the company is performing.

Bookkeeping is the method used to record all the financial transactions, essentially the day to day accounting operations. Luca

Pacioli is often referred to as the “father of accounting” because he

was the first to publish a book regarding the double entry method of

bookkeeping. If you ever heard of debits and credits, those are bookkeeping terms.

There are many governing bodies and organizations. The International Accounting Standards Board (IASB) governs the general globe. Many countries often adhere to their own standards as well. Here in the United States, the Generally Accepted Accounting Principles (GAAP) guides the accounting field and its profession. Some characteristics of GAAP are Relevance, Timeliness, Reliability, Comparability, and Consistency. Accounting can further breakdown in sub-categories like Tax, Corporate, Audit, Management, and even Financial Accounting.

Finance:

Finance covers a huge array of subjects, but the

three main terms when comparing to accounting would be: (1) the study of

money and capital markets which deals with many of the topics covered

in macro economics (2) management and control of assets and investments,

which focuses on the decisions of individual and financial and other

institutions as they choose securities for their investments portfolios,

and (3) managerial finance (business finance) which involves the actual

management of the firm, as well as profiling and managing project

risks.

Managerial

finance is probably the most important to all types of businesses,

whether they are public or private, deal with financial services or are

manufacturers. Managerial finance also involves analyzing

the performance of the firm in order to forecast its future performance.

It involves making decisions regarding working capital issues such as

level of inventory, cash holding, credit levels, etc.

Economics:

Economics has two sections, microeconomics and macroeconomics.

Microeconomics is study focusing at the firm level, while

macroeconomics focuses more at the policy and regulatory levels.

Accounting uses principles to justify many of its actions, while

Economics uses assumptions to simplify a situation. Many

economics decisions as based on certain assumptions. When the

assumptions don’t hold then the specific decision may also be affected.

The key principles for economics are opportunity

cost, diminishing returns, the marginal principle, spillover, and the

reality principle.Refer:http://thefinancepig.com/2008/03/21/what-is-the-difference-between-accounting-and-finance-and-economics/

Saturday, January 04, 2014

Operations - Competitive Priorities (AKA Process Performance Objective)

1. Cost

2. Quality

- Consistent Quality - On-specification Product

- Top Quality - Superior Design / Durability etc.,

- Quick Delivery

- On-Time Delivery - Important requirement for Just-In-Time (JIT)

- Time-to-Market for New Product or Service Development and to market the same.

- Customization

- Variety

- Volume Flexibility

Operations Strategy - Competitive Priorities

Thursday, January 02, 2014

What is the difference between preferred stock and common stock?

First, preferred stockholders have a greater claim to a company's assets and earnings. This is true during the good times when the company has excess cash and decides to distribute money in the form of dividends to its investors. In these instances when distributions are made, preferred stockholders must be paid before common stockholders. However, this claim is most important during times of insolvency when common stockholders are last in line for the company's assets. This means that when the company must liquidate and pay all creditors and bondholders, common stockholders will not receive any money until after the preferred shareholders are paid out.

Second, the dividends of preferred stocks are different from and generally greater than those of common stock. When you buy a preferred stock, you will have an idea of when to expect a dividend because they are paid at regular intervals. This is not necessarily the case for common stock, as the company's board of directors will decide whether or not to pay out a dividend. Because of this characteristic, preferred stock typically don't fluctuate as often as a company's common stock and can sometimes be classified as a fixed-income security. Adding to this fixed-income personality is the fact that the dividends are typically guaranteed, meaning that if the company does miss one, it will be required to pay it before any future dividends are paid on either stock.

To sum up: a good way to think of a preferred stock is as a security with characteristics somewhere in-between a bond and a common stock.

Wednesday, January 01, 2014

Fortune 100 - Vision & Mission

Understanding the fundamental difference between Mission and Vision is critical to anyone aspiring to become a business leader. I found the following presentation with the Fortune 100 companies vision & mission statements. Please click the below.

Fortune 100 - Vision & Mission Statements

Financial Ratios

Pleae click the link ---> Financial Ratio Analysis Spreadsheet

Project Planning with Sticky Notes

Subscribe to:

Comments (Atom)